sales tax calculator memphis tn

US Sales Tax. You can calculate the sales tax in Tennessee by multiplying the final purchase price by 07.

Calculate Taxes Shelby County Trustee Tn Official Website

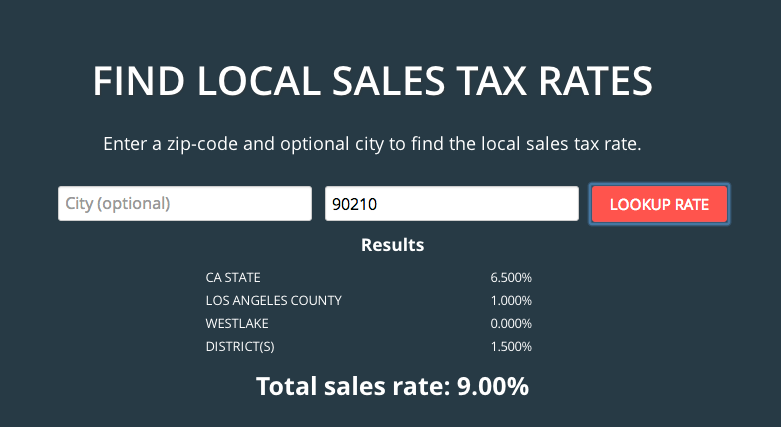

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

. This is the total of state and county sales tax rates. The current total local sales tax rate in Memphis TN is 9750. Tennessee collects a 7 state sales tax rate.

Tennessee Department of Revenue. Sales Tax Calculator in Memphis TN. The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections.

Before-tax price sale tax rate and final or after-tax price. Sales Tax on Motor Vehicles - for County Clerks Keywords. For example lets say that you want to purchase a new car for 60000 you would use.

Other taxes collected by the City of Memphis include Payment in Lieu of Taxes PILOT and Central Business Improvement District CBID taxes for taxable entities in the Downtown. Name A - Z Sponsored Links. The minimum combined 2022 sales tax rate for Memphis Tennessee is.

Sales. Sales Tax on Motor Vehicles - for County Clerks Author. Memphis collects the maximum legal local sales tax.

The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Tennessee has a 7 statewide sales tax rate but. Tennessee Department of Revenue Subject.

The 975 sales tax rate in memphis consists of 7 tennessee state sales tax 225 shelby county sales tax and 05 memphis tax. Tax Return Preparation 901 417. This is the total of state county and city sales tax rates.

The Tennessee state sales tax rate is currently. The 2018 United States Supreme Court. There is base sales tax by Tennessee.

Vehicle Sales Tax Calculator. Name A - Z Sponsored Links. The Tennessee sales tax rate is currently.

You can find more tax rates and allowances for. Milan Milan Bookkeeping Tax Service. To calculate the amount of your taxes multiply the assessed value of your property times the tax rate divided by 100.

For vehicles that are being rented or leased see see taxation of leases and rentals. Counties cities and districts impose their own local taxes. There is a maximum tax charge of 36 dollars for county.

The sales tax is comprised of two parts a state portion and a local. The state single article sales tax and the local option single article sales tax limitation will apply to a lease of tangible personal. The 975 sales tax rate in Memphis consists of 7 Tennessee state sales tax 225 Shelby County sales tax and 05 Memphis.

The December 2020 total local sales tax rate was also 9750. Calculator for Sales Tax in the Memphis. WarranteeService Contract Purchase Price.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Memphis TN. Sales Tax on Motor. The Shelby County sales tax rate is.

Sales Tax Calculator in Memphis TN.

Special Sales Tax Board Tuscaloosa County Alabama

Nebraska Sales Tax Rates By City County 2022

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

![]()

Tennessee Paycheck Calculator 2022 With Income Tax Brackets Investomatica

How To Collect Sales Tax Through Square Taxjar

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

States That Do Not Tax Earned Income

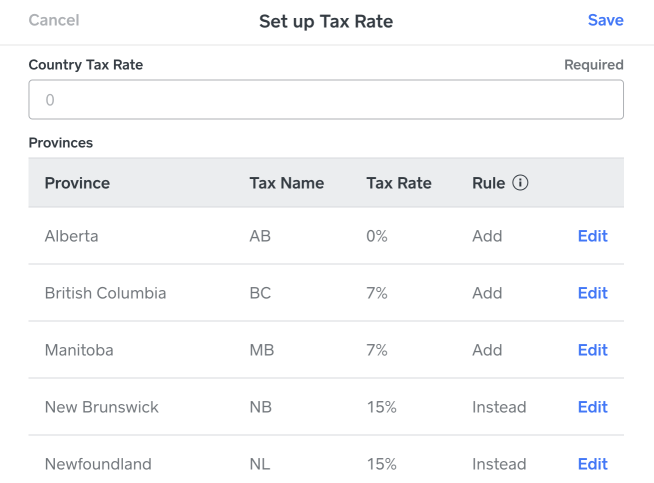

Create Tax Rates Weebly Support Us

169 Heritage Lake Dr Memphis Tn 38109 Realtor Com

Tennessee Income Tax Calculator Smartasset

Tennessee Retirement Tax Friendliness Smartasset

Taxation Solutions Inc Tax Services 1661 International Dr Memphis Tn Phone Number Yelp

Tennessee Grocery Tax Cut For 30 Days Localmemphis Com

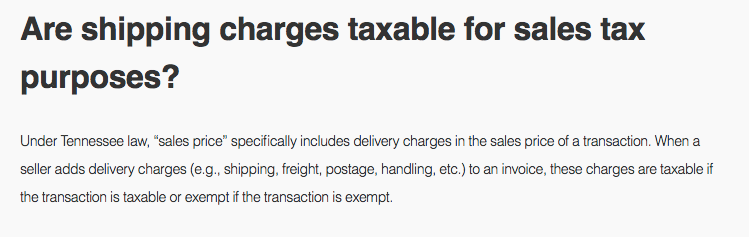

Is Shipping In Tennessee Taxable Taxjar

How To Calculate Sales Tax Youtube

Tennessee Grocery Tax Cut For 30 Days Localmemphis Com